Process Overview

Initiation

- Review within your Department (Chair/Finance Manager) regarding creating a core.

- Department accesses the Core in a Box website to complete business plan using standard templates.

- Submit form to Office for Faculty Research Resources for review.

- The Office for Faculty Research Resources will review and provide guidance for the preparation business plan before it is officially submitted.

- All new core facilities will be required to implement the iLab core management program.

Assessment

- Department submits proposal to their Business Office for financial review and approval.

- Business Office forwards application to Scientific Review Committee (if applicable) for scientific review and approval.

Development

- Cost Analysis reviews business plan and rate worksheet for approval.

- Department works with Fixed Assets to create depreciation schedule for new equipment purchases.

Implementation

- Department requests new internal order through Master Data Request Form

- Department creates iLab account, core ewebsite, completes training module, and communicates Go-Live information.

Monitoring

- Department submits annual budget, rate review, and core updates to Cost Analysis and their Business Office.

- Requests to establish a service center cost object should be submitted by the requesting department through the Divisional Business Office to the Office of Cost Analysis.

- The service center must meet the necessary criteria stated in the policies, and the request must be submitted with all the required information below.

- If the Divisional Business Office and Office of Cost Analysis approve the request, the department is notified and must complete the Master Data Creation form.

- The Master Data Creation form is sent to the HopkinsOne Support Team (HOST), and a unique fund number and cost object will be assigned and set up in SAP by HOST.

Contact [email protected] for more information.

New Core Proposals

A proposal for a new core includes a business plan that contains information for a financial review and a scientific review. Faculty members are encouraged to engage the appropriate dean of research and Business Office in early discussions of the scientific component to reduce the possibility of duplication of resources.

Please provide answers to the following questions for financial review of your new core facility:

- A detailed description of the proposed goods or services to be provided

- The users (customers) of the services and their funding source (i.e., general funds, grants, clinical fees)

- A justification for the proposed service

- The frequency and method of collecting revenues and the basis which revenue is billed

- Detailed five-year projections of costs and revenues

- A five-year capital budget for equipment and other capital expenditures

- A rate schedule supported by documentation of cost and use estimates for the first fiscal year

- A cost object that would be used to cover any deficits (a default cost object)

- A person who will be responsible for the operation of the service center

Please provide answers to the following questions for scientific review of your new core facility:

- Does this overlap with any existing Johns Hopkins University service centers/cores? If so, please describe how the proposed service center/core avoids duplication with the existing service.

- Can the proposed services be obtained from an outside vendor or contract research organization, and if so, at what cost?

- If services have already been provided, please provide usage statistics, broken down by department/division.

- (Optional) If previous services have not been provided, use a similar service center/core from the local geographic region and provide a comparison to that core, with a specific focus on services offered, pricing and usage.

- With a focus on scientific expertise, please provide justification for the personnel.

- Is there an advisory/oversight committee?

- What additional funding exists to support the service center/core?

- Will the core/service center be supported through user fees or grants?

- Is there a specific request for subsidy/other resources to be provided by the university?

- Where will the services provided take place?

Process Review for an Institutional Service Center Core Facility

- After the scientific justification and business plan have been developed, the proposal is submitted to your local Business Office for review and approval.

- Business Office will forward the application to the Research Core Scientific Review Committee for review.

- The proposal will be evaluated by both groups based on need, anticipated use, appropriateness of the recommended financial model — including any necessary anticipated subsidies — etc. Additional information may be requested to make a final recommendation.

- If the Research Core Scientific Review Committee supports the establishment of the core, the approval is forwarded to the appropriate Business Office.

- If the core advisory committee does not recommend a core for approval, the committee will provide feedback allowing for a resubmittal in some cases.

- Once the financial and scientific review processes are complete, the application will be forwarded to the Office of Cost Analysis for final review and approval.

- The scientific/core director may request an internally designated account from the Service Center Administration.

- Scientific/core directors may also work with the fixed assets department if they have questions about the depreciation schedule for new equipment purchases.

- Departmental finance staff may also submit a request for a new internal order or cost center through the Master Data Request form.

- Once approved, a new core facility can begin the hiring process for new staff, ordering equipment, creating an iLab presence, developing its own Web pages, complete the core facility training module and continue to use the Core in a Box resources.

Setting Rates

- All service centers must determine what products or services they are going to sell and the related costs of producing those products and services.

- Federal regulations (Cost Principles for Educational Institutions OMB Circular A-21 (2 CFR Part 220)).

- It is required that the cost of the goods and services, when material, be charged directly to the applicable awards based on the actual usage of goods and services, and on a basis of a schedule of rates that does not discriminate against federally sponsored activities of the institution, including usage by the institution for internal purposes.

- Rates must be designed to recover only the aggregate costs of the services and shall be adjusted at least every other year, taking into consideration any operating deficit or surplus of the previous period(s).

- Over time, the service center should break even or recover no more that the total cost of proving the product or service.

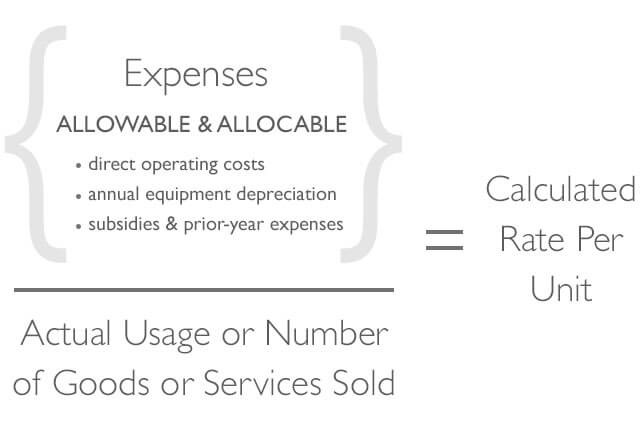

The general formula for calculating rates divides annual allowable expenses by the annual usage basis for each product or service. The usage base is the volume of work expected to be performed expressed in units, such as labor hours, machine hours, CPU time or any other reasonable measurement. A separate rate must be calculated for each discrete product or service offered by the service center to users. Bundling of certain products or services is allowable but should be discussed with the Office of Cost Analysis.

When developing your rate schedule, typical allowable costs may include:

- Labor (salary and fringe for staff)

- Operating supplies and materials

- Service contracts for core equipment

- Depreciation on non-federally purchased equipment (not included in the F&A cost pool)

Certain costs are unallowable and cannot be included in the rate calculations. Some examples include:

- Advertising (exclusive of exemptions deemed allowable in applicable cost principles, e.g., personnel recruiting);

- Alcoholic beverages

- Bad debts

- Contributions and donations

- Entertainment expenses

- Fundraising

- Public relations

These lists are not comprehensive. Refer to Cost Principles for Educational Institutions OMB Circular A-21 (2 CFR Part 220), for more details or contact the Office of Cost Analysis if you have specifics questions.

Budget Planning Template

Cores should review budget templates with the work group and develop final version(s).